The GeoBuiz 2018 Report presents a bright outlook for the geospatial industry and predicts a larger role for it in the Fourth Industrial Revolution. Geospatial is more aligned with ICT and Cloud, IoT, Big Data, Artificial Intelligence, and Blockchain are key technology drivers.

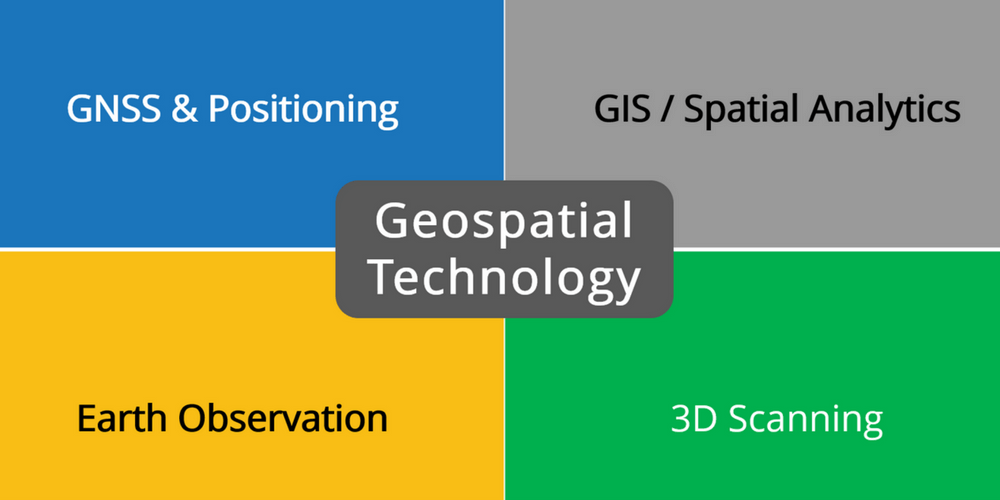

Geospatial Technology

The Geospatial industry is a dynamic ecosystem of entities that work with technologies that have a geographic or locational component. These technologies have their unique history and origin, some dating back to the 1960’s and 70’s and others being very recent. Due to technology convergence, a market demand for end-to-end solutions, and a shift from technical to domain expertise, the once disparate technologies are becoming increasingly interlinked and consolidated.

The GeoBuiz 2018 Report categorizes the industry in four major technology segments, looks at global and regional market sizes, identifies the main technology and industry drivers, and discusses the latest trends and innovations. Here are some of its key findings:

- The cumulative value of the Geospatial industry was estimated at US$ 299.2 Billion in 2017 and is projected to reach US$ 439.2 Billion by 2020 growing at a CAGR of 13.6%.

- The four major segments in the Geospatial industry in order of 2017 market share are GNSS & Positioning (59.6%), GIS/Spatial Analytics (20.8%), Earth Observation (16.7%), and 3D Scanning (2.9%).

- The regional market share estimated for 2020 is North America (31.5%), Europe (24.6%), Asia-Pacific (32.6%), South America (5.5%), Middle East (3.1%) and Africa (2.7%).

- Big Data, Cloud, Artificial Intelligence (AI), Internet of Things (IoT), Augmented and Virtual Reality (AR/VR) and Automation are expected to drive the adoption of Geospatial technology.

Let’s now take a closer look at the 4 major technology segments within the Geospatial industry.

GNSS & Positioning

GNSS & Positioning comprises navigation, surveying, and indoor mapping as distinct technology areas though the latter is a relative newcomer. GNSS & Positioning is already the biggest segment in the Geospatial industry and is expected to grow even further with accelerated growth in navigation.

GNSS (Global Navigation Satellite System) is a relatively new term compared to GPS (Global Positioning System) and testifies of an expanding number of satellite constellations (GPS, Galileo, GLONASS, BeiDou) and augmentation services that increase reliability and accuracy.

Satellite navigation has invaded the consumer space with GNSS-enabled devices and forms the backbone of commercial applications in transportation and aviation. Future growth is driven by IoT and Big Data Analytics and the adoption of smart initiatives in cities, utilities, and transportation.

The surveying industry increasingly relies on GNSS to get the work done but continues to use other positioning systems and traditional instruments like total stations. This is particularly true in areas where highly accurate GNSS positioning is unavailable. The demand for surveying is not diminishing, but efficiency gains by modern surveying techniques are putting a lid on the growth of this segment.

Developing countries could fall behind in the adoption of GNSS & Positioning due to inadequate network infrastructure and poor positioning reference system. To bridge the ‘digital divide’ these countries must invest in a physical addressing system and a GNSS-based geodetic reference frame.

GIS / Spatial Analytics

GIS is used to create, store, manage, analyze, and present geographic data such as maps and satellite imagery. When geo-referencing non-spatial data GIS becomes a natural system of integration using location as a reference. Such an integrated system has extensive analytical capabilities for the discovery of unseen relationships, patterns, and trends.

The term GIS is increasingly interchanged with Location Intelligence and Spatial Analytics. Some argue that GIS is dead, but to others, it indicates that GIS has evolved into a set of capabilities that can be embedded into or integrated with other ICT systems.

GIS can be categorized as Desktop GIS running on a PC, Mobile GIS running on a tablet or smartphone, Web/Cloud GIS accessible via a web browser, Enterprise GIS running in a Server/Client architecture and Embedded GIS running within other systems and applications. These distinctions are not necessarily helpful considering that GIS is best deployed in several or all forms.

Open source software and cloud computing have made GIS more affordable by lowering the upfront investment cost. But internal turf wars and a map-centric view of GIS have blurred its value proposition to many of its potential users. The emergence of Big Data Analytics, IoT, and AI could herald a rebirth since these technologies were inherent to GIS before they came to the fore.

Earth Observation

Earth Observation / Remote Sensing uses airborne sensors to capture information about our planet and the earth’s surface. The sensors are fitted on satellites, planes and more recently drones / UAVs (Unmanned Aerial Vehicles). Earth Observation applications are widespread and include weather observation, environmental monitoring, mineral exploration, and precision agriculture.

Remote sensing has benefitted from free public access to USGS/NASA’s Landsat and ESA’s Copernicus Sentinel satellite imagery. More so because commercial operators like DigitalGlobe and Planet had to respond with better spatial, temporal, and spectral resolution of their imagery and commercial end-to-end solutions. The recent development of small and low-cost satellites pushes the boundaries even further with the entry of new companies and countries.

Aerial mapping is still expected to grow due to the increasing demand for oblique imagery in urban management and security applications. UAV-based mapping is particularly suitable for the on-demand mapping of smaller areas. It has bright prospects in agriculture and mining but is still hindered by restrictive or unclear regulations, particularly in developing nations.

3D Scanning

Airborne and terrestrial LiDAR (Light Detection and Ranging) is rapidly gaining popularity, and RADAR (Radio Detection and Ranging) continues to be used for its unique penetrating capabilities. Both are 3D Scanning techniques, but RADAR uses radio waves while LiDAR uses laser light to capture data as a massive point cloud.

LiDAR is used in GIS to derive elevation layers (DSM, DTM) and has wide use in engineering and construction applications. In Earth Observation RADAR and LiDAR are used as active remote sensing techniques which complement passive techniques subject to light and atmospheric conditions. Surveyors use LiDAR to capture buildings, construction progress and stockpile volumes and ground-penetrating RADAR to map underground infrastructure.

RADAR and particularly LiDAR are used across the Geospatial industry and exhibit huge potential for future growth, so 3D Scanning has become a segment on its own. Its main technology drivers are Big Data Analytics and Cloud Computing and AEC (Architecture, Engineering, Construction) is an industry where high growth is expected. 3D Scanning is easy, fast, and accurate, but the acquisition cost of the equipment remains high.

Wrapping Up

In this article, we discussed the four major technology segments of the Geospatial industry. All segments are projected to grow at a double-digit CAGR over the coming years. The outlook for 3D Scanning and Satellite navigation looks particularly bright.

Africa is the second largest and second most-populous continent, but it has the lowest regional market share at 2.7%. The continent is already the poorest and most underdeveloped and could fall further behind if it fails to benefit from the value and impact of the Geospatial industry.

The small market size of Geospatial technology in Africa is a compounded problem with poor positioning infrastructure, lack of enabling policies and low adoption of technology as underlying causes. This suggests that Governments need to take a pro-active and leading role in the development of the Geospatial industry. What are your thoughts?